Instant Finality Comparison Tool

This tool compares the finality times of various blockchain networks to help you understand how instant finality differs from traditional probabilistic approaches.

Blockchain Performance Comparison

| Blockchain | Consensus Engine | Finality Time |

|---|---|---|

| Sei Network | Twin-Turbo | ≈ 0.4 seconds |

| Avalanche | Snowman | ≈ 0.8 seconds |

| Near Protocol | Nightshade + BFT | ≈ 2 seconds |

| Solana | Proof-of-History + BFT | 2-5 seconds |

| Cosmos (Tendermint) | Tendermint BFT | ≈ 6 seconds |

| Bitcoin (PoW) | Proof-of-Work | ≈ 60 minutes (6 confirmations) |

| Ethereum (PoW, pre-Merge) | Proof-of-Work | ≈ 10-30 minutes (6 confirmations) |

Understanding Finality

Instant Finality: Transactions are permanently confirmed immediately upon validation, with no chance of reversal.

Probabilistic Finality: Confirmation builds over time through block accumulation, with increasing certainty but risk of reversal.

Modern instant-finality chains like Sei, Avalanche, and Near deliver finality in under 2 seconds, compared to Bitcoin's 60-minute wait.

When a transaction is recorded on a blockchain, you want to know instantly whether it’s final or not. Instant finality is a property of certain blockchain networks where a transaction becomes permanent and irreversible the moment it is validated, with no need to wait for additional blocks. This contrasts sharply with the probabilistic approach used by early chains like Bitcoin, where certainty only builds over time. Below you’ll see how instant finality is achieved, why it matters for modern finance, and which platforms are leading the race.

How Instant Finality Works

The magic behind instant finality lies in the consensus algorithm. Instead of letting blocks accumulate and hoping the odds of reversal drop, the network forces validators to reach a near‑unanimous agreement before a transaction is written. This is typically done with a Byzantine Fault Tolerant (BFT) consensus protocol that can tolerate up to one‑third of malicious participants while still guaranteeing safety. Once the required quorum signs off, the transaction is locked in forever.

Most modern instant‑finality chains pair BFT with proof‑of‑stake (PoS) where validators lock up economic value as collateral, aligning their incentives with honest behavior. The stake acts as a security bond: if a validator tries to cheat, they stand to lose their locked tokens, making attacks economically unattractive.

Key Consensus Mechanisms Driving Instant Finality

- Tendermint a BFT engine used by Cosmos SDK chains, delivering finality within roughly six seconds.

- Avalanche’s Snowman a DAG‑based protocol that finalizes transactions in sub‑second intervals.

- Twin‑Turbo (Sei Network) a custom BFT variant that pushes finality below 400ms for high‑frequency trading workloads.

All three share the same safety‑first philosophy: before a block is committed, a super‑majority of validators must sign, guaranteeing that the state cannot be rewritten.

Performance Benchmarks

| Blockchain | Consensus Engine | Typical Finality Time |

|---|---|---|

| Sei Network | Twin‑Turbo | ≈0.4seconds |

| Avalanche | Snowman | ≈0.8seconds |

| Near Protocol | Nightshade + BFT | ≈2seconds |

| Solana | Proof‑of‑History + BFT | 2‑5seconds |

| Cosmos (Tendermint) | Tendermint BFT | ≈6seconds |

| Bitcoin (PoW) | Proof‑of‑Work | ≈60minutes (6 confirmations) |

| Ethereum (PoW, pre‑Merge) | Proof‑of‑Work | ≈10‑30minutes (6 confirmations) |

Instant vs. Probabilistic Finality: Core Differences

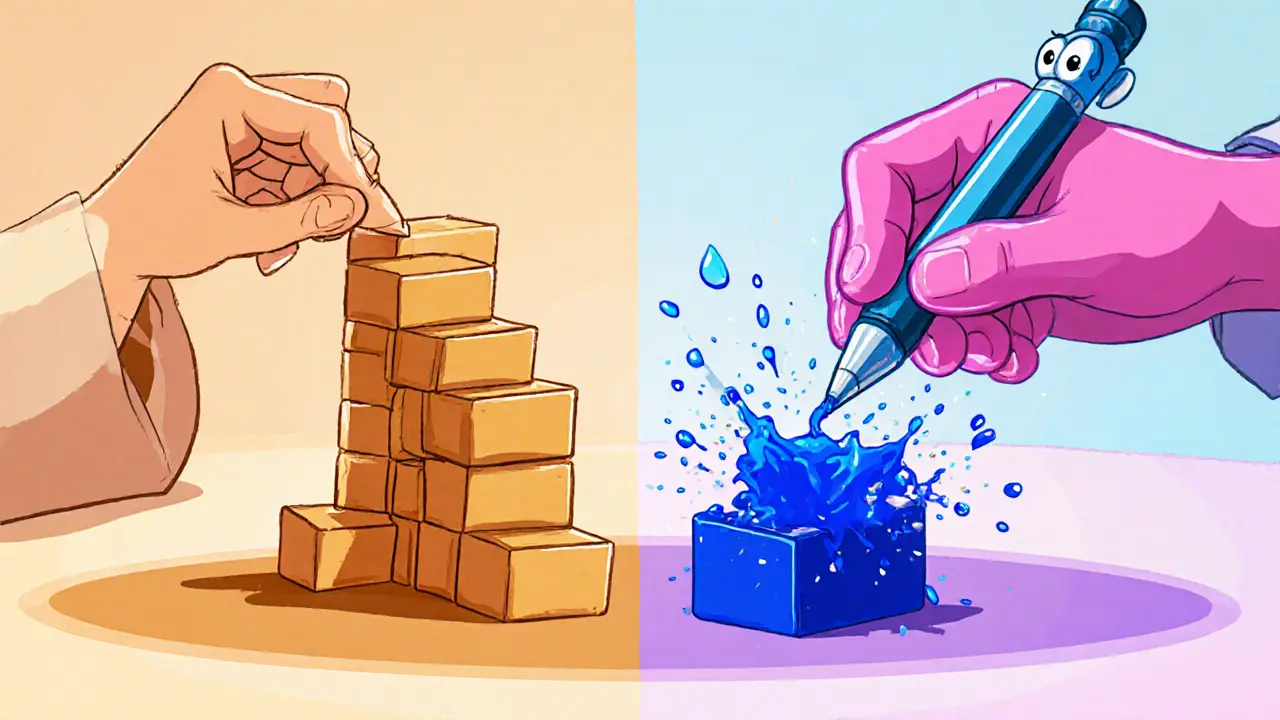

Think of probabilistic finality like writing with a pencil-each new block adds more pressure, making it harder to erase but never truly permanent. Instant finality is more like ink: once the validator set signs off, the entry is immutable. This leads to two practical consequences:

- Speed. Users get immediate confidence, which is crucial for high‑frequency trading, DeFi arbitrage, and real‑time payments.

- Network composition. Instant‑finality chains usually run with a tighter validator roster (dozens to a few hundred), whereas probabilistic chains can support thousands of miners without coordination.

Both models have their merits. Probabilistic systems shine in pure decentralization and censorship resistance, while instant‑finality platforms excel in predictability and user experience.

Real‑World Use Cases

Instant finality unlocks scenarios that were previously impractical on Bitcoin‑style chains:

- DeFi settlement. Automated market makers can rebalance pools instantly, removing the risk of front‑running caused by delayed confirmations.

- Cross‑chain atomic swaps. With immediate confirmation, two parties can exchange assets across different blockchains in a single atomic operation.

- Enterprise payments. Companies can integrate blockchain‑based invoicing into ERP systems, knowing the funds are settled the moment the transaction is broadcast.

Trade‑offs and Challenges

While the speed advantage is clear, instant‑finality designs face criticism:

- Reduced decentralization. Smaller validator sets mean a higher concentration of power, which could raise governance concerns.

- Complexity. BFT protocols require sophisticated networking and cryptography; bugs can lead to total network stalls.

- Economic barriers. Staking large amounts to become a validator can exclude smaller participants, potentially limiting network diversity.

Researchers are already exploring hybrid models that retain instant finality while scaling validator numbers, such as sharded BFT or layered solutions that combine a fast “settlement layer” with a slower “security layer.”

Future Outlook

Market analysts predict that as DeFi matures and enterprises demand real‑time settlement, instant‑finality chains will capture a growing slice of blockchain volume. Venture capital investment in projects focused on sub‑second finality has surged in 2024‑2025, indicating confidence in the model. Meanwhile, legacy chains like Bitcoin and Ethereum are experimenting with layer‑2 rollups that provide instant finality for specific use cases, suggesting a convergence rather than a binary split.

In the long run, the industry may settle on a two‑tier architecture: a base layer offering maximal decentralization and security, and a rapid settlement layer delivering instant finality for high‑value, time‑sensitive transactions.

Key Takeaways

- Instant finality turns transaction confirmation into an immediate, irreversible event.

- It relies on BFT consensus paired with proof‑of‑stake economics.

- Current leaders-Sei Network, Avalanche, Near-deliver finality under 2seconds, far faster than Bitcoin’s hour‑long wait.

- The speed boost enables real‑time DeFi, cross‑chain swaps, and enterprise payments.

- Trade‑offs include tighter validator sets and higher protocol complexity.

Frequently Asked Questions

What exactly does "instant finality" mean?

It means a transaction becomes permanently recorded the moment the network’s validators reach consensus, with no additional blocks needed to increase confidence.

How do BFT consensus algorithms ensure safety?

BFT requires a super‑majority (usually >2/3) of validators to sign a block. Even if up to one‑third act maliciously, the honest majority can outvote them, preventing any rewrites.

Why do instant‑finality chains often have fewer validators?

Coordinating thousands of participants quickly is hard. Smaller, well‑bonded validator sets can exchange messages and achieve agreement in milliseconds, which is essential for instant finality.

Can I use an instant‑finality blockchain for large‑scale payments?

Yes. Companies are already piloting settlement pipelines on Avalanche and Near because the predictable sub‑second finality meets compliance and accounting requirements.

Is instant finality more secure than Bitcoin’s probabilistic model?

Security is measured differently. Bitcoin’s massive mining pool offers unparalleled decentralization, while instant‑finality chains trade some decentralization for immediate certainty. Both are secure within their design assumptions.

Write a comment