Crypto Regulations Checker

Check Your Country's Crypto Regulations

Find out how your country classifies crypto, key requirements, and where to get official information.

Select a country to see its crypto regulations status.

Not all crypto rules are the same. What’s legal in Singapore could land you in jail in Algeria. If you’re trading, investing, or running a business with cryptocurrency, you can’t afford to guess. Your jurisdiction’s rules aren’t just paperwork-they directly affect what you can buy, how much you pay in taxes, and whether your funds are protected if something goes wrong.

How Your Country Classifies Crypto

Every country falls into one of three buckets: restrictive, neutral, or crypto-friendly. It’s not about opinion-it’s about legal structure and enforcement.Restrictive countries like China, Algeria, and Bangladesh have outright bans. China shut down mining in 2022 and blocks all domestic exchange access. In Algeria, holding crypto can mean 2-5 years in prison under a 2012 ordinance. Bangladesh treats crypto as illegal under its Money Laundering Prevention Act, and enforcement tightened in early 2025.

Neutral countries treat crypto like any other asset. The U.S. is the clearest example. No federal ban, but no unified rules either. The SEC says most tokens are securities and must be registered. The CFTC treats Bitcoin as a commodity. The IRS taxes it as property. You need to comply with all three at once-and 50 state regulators on top of that. Coinbase spends $120 million a year just navigating this mess.

Crypto-friendly jurisdictions build systems around it. The UAE’s ADGM and DIFC offer full licensing, zero capital gains tax, and a dedicated regulator (VARA). Switzerland’s ‘Crypto Valley’ in Zug has clear rules since 2019, updated in early 2025. Singapore’s MAS requires licensing but gives clear guidelines-287 pages of them, updated quarterly. These places attract businesses because they reduce uncertainty.

What You’re Required to Do

If you’re using crypto, you’re probably subject to at least one of these four requirements:- Licensing - If you run an exchange, wallet service, or staking platform, you need a license. In the EU under MiCAR, you need approval from your national authority. Fees range from €5,000 in Malta to €25,000 in France. Minimum capital? At least €150,000. In South Africa, the FSCA licensed 138 crypto service providers by April 2024.

- AML/CFT compliance - Know Your Customer (KYC) and transaction monitoring are mandatory almost everywhere. The FATF’s updated Travel Rule, effective in 2025, requires VASPs to collect and send beneficiary data for transactions over $3,000. That’s not optional. If you’re using a non-compliant exchange, your funds could be frozen.

- Tax reporting - Crypto is taxed differently everywhere. In Germany, holding for over a year means zero tax. In Portugal, capital gains are taxed at 28%. In India, you pay 30% on gains plus 1% TDS on every trade. A 20% profit? After taxes, you’re left with just 13.2%. The IRS requires Form 8949 and Schedule D. Failing to report can trigger audits or penalties.

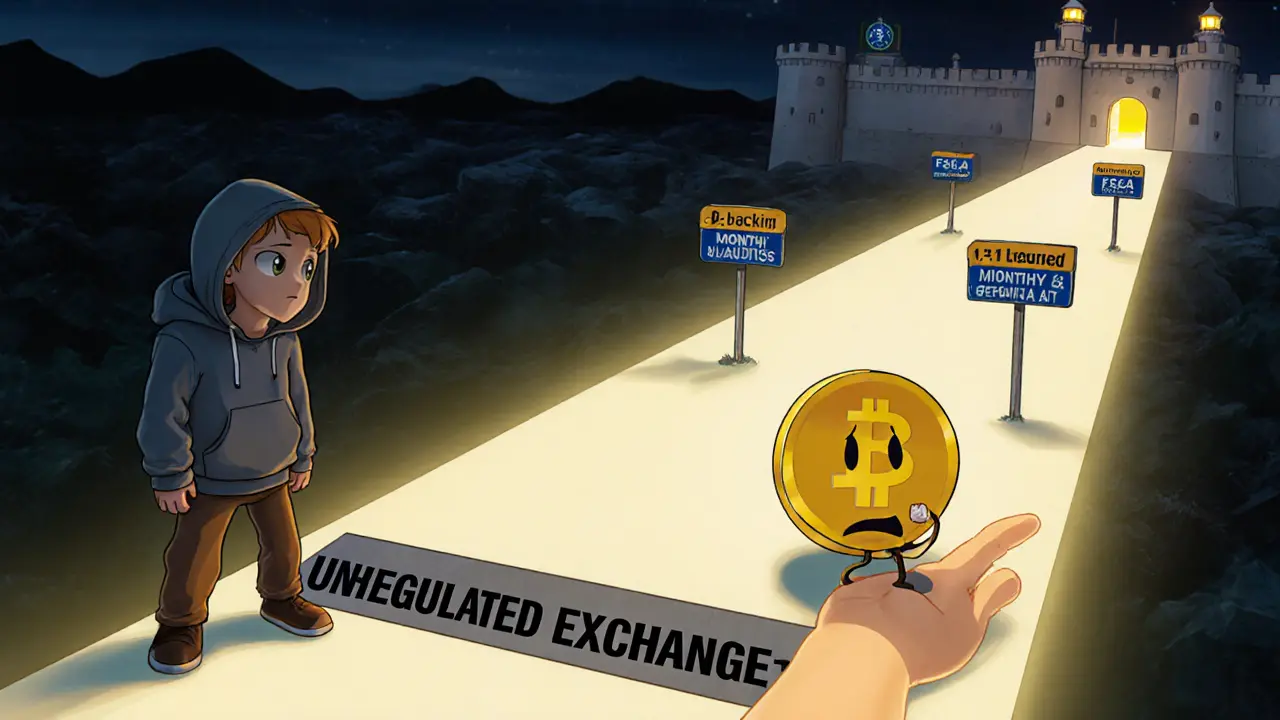

- Stablecoin rules - If you use USDT, USDC, or any pegged token, you’re affected by new rules. The U.S. GENIUS Act (July 2025) requires 1:1 backing with U.S. dollars or Treasury bills, monthly audits, and public reports. The EU’s MiCAR demands the same. If a stablecoin issuer fails, you could lose your money-unless the jurisdiction requires reserve transparency.

Where the Rules Are Changing Fast

Regulation isn’t static. It’s evolving every month.In the EU, MiCAR is now fully active. That means exchanges can no longer offer staking for unregistered tokens. Users on Reddit reported losing €1,850 in annual yield after 23 tokens were removed from their platforms. The EU is now drafting MiCA II to cover DeFi and NFTs.

The U.S. is moving toward federal stablecoin rules. The Clarity for Payment Stablecoins Act passed the Senate Banking Committee in March 2025 with bipartisan support. If it becomes law, it will create a national charter system-finally ending the state-by-state chaos.

South Africa is working to get off the FATF’s gray list by December 2025. They’ve already licensed 138 CASPs and are testing a CBDC. Users on Twitter say they’ve recovered funds from hacked accounts thanks to mandatory insurance requirements under FSCA rules.

Switzerland updated its FINMA guidelines in March 2025 to clarify security token offerings under the revised Financial Services Act. Singapore revised its digital token guidelines in January 2025 to include DeFi protocols under licensing.

What This Means for You

If you’re an individual investor: know your tax obligations. Track every trade. Use software that auto-generates reports for your country’s tax authority. Don’t assume your exchange does it for you. In the U.S., Coinbase reports to the IRS-but only for users who meet thresholds. You’re still responsible for reporting everything.If you’re a business: don’t operate across borders without legal review. A company based in Canada that serves EU customers must comply with MiCAR. A U.S.-based exchange that allows Indian users must navigate both IRS rules and India’s 30% tax + TDS. Most startups now hire full-time compliance officers-up from 32% in 2022 to 68% in 2025.

If you’re in a restrictive country: understand the risks. Peer-to-peer trading is still happening in China and India, but it’s unregulated. No protection. No recourse. Chainalysis estimates $15-20 billion in P2P volume in China alone-despite the ban. That’s the underground economy. It’s not safer. It’s just hidden.

How to Find Your Local Rules

You can’t rely on Google. Search results are outdated or biased. Here’s how to find real, current rules:- Check your central bank’s website - Most countries have a dedicated crypto page. Look for terms like ‘digital assets,’ ‘virtual currencies,’ or ‘crypto regulation.’

- Find your financial regulator - In the U.S., that’s the SEC, CFTC, and FinCEN. In the UK, it’s the FCA. In Australia, it’s ASIC. Search their official publications.

- Look for licensing lists - If your country licenses crypto firms, they publish the list. That’s proof of what’s legal. South Africa’s FSCA and Singapore’s MAS both have searchable directories.

- Read the fine print on tax forms - Tax authorities often define crypto in their guidelines. The IRS, HMRC, and ATO all have detailed crypto sections.

- Ask a local crypto lawyer - Not a forum post. Not a YouTube video. A licensed professional who handles financial regulation in your country.

Why This Matters More Than Ever

In 2022, only 52% of countries had crypto rules. By 2025, it’s 78%. The World Economic Forum found that jurisdictions with clear rules get 37% more institutional investment. The top 10 compliant exchanges now control 76% of global trading volume.Regulation isn’t killing crypto-it’s cleaning it up. The companies that survive are the ones that follow the rules. The investors who thrive are the ones who understand them.

Ignoring your jurisdiction’s laws won’t make them disappear. It just makes you vulnerable-to frozen accounts, tax penalties, or worse. Your crypto isn’t lawless. It’s regulated. And the rules are here to stay.

Is crypto legal in my country?

There’s no global answer. Over 195 countries have different rules. China and Algeria ban it. The U.S. regulates it through multiple agencies. The UAE and Switzerland welcome it with clear licenses. Check your country’s central bank or financial regulator’s official website for the most accurate, up-to-date status.

Do I have to pay taxes on crypto gains?

Yes, in nearly every country. How you pay depends on where you live. In the U.S., crypto is taxed as property-capital gains apply. In Germany, holdings over one year are tax-free. In India, you pay 30% on gains plus 1% tax deducted at source on every trade. In Portugal, it’s 28%. Always check your national tax authority’s guidance. Failing to report can lead to audits, fines, or criminal charges.

Can I use a foreign crypto exchange?

It depends. In the EU, MiCAR requires you to use only licensed exchanges. In the U.S., using a foreign exchange doesn’t exempt you from IRS reporting. In countries like India and Bangladesh, using foreign exchanges may violate local law. Even if you can access it, your funds may not be protected, and you could be breaking local rules. Always verify whether your country allows residents to use foreign platforms.

What happens if I don’t comply with crypto laws?

Consequences vary. In restrictive countries like Algeria or Bangladesh, you could face imprisonment. In the U.S. or EU, you might get fined, have your accounts frozen, or be barred from operating a business. Tax evasion can trigger audits, penalties, or criminal charges. Even if you’re not caught today, regulators are getting better at tracking transactions. Compliance isn’t optional-it’s your protection.

Are stablecoins safe under new regulations?

They’re safer in regulated jurisdictions. The U.S. GENIUS Act and EU MiCAR now require stablecoins to be backed 1:1 by cash or Treasury bills, with monthly audits. This reduces the risk of collapse. But unregulated stablecoins still exist. If a stablecoin isn’t issued by a licensed entity in a compliant jurisdiction, it’s not protected. Always check if your stablecoin issuer is regulated and audited publicly.

How do I know if my crypto exchange is compliant?

Look for a public license number on their website. In the EU, check the national regulator’s list (e.g., Germany’s BaFin, France’s AMF). In Singapore, use MAS’s licensed entities directory. In South Africa, visit the FSCA’s CASP register. If they don’t display their license or you can’t verify it on the official regulator’s site, assume they’re not compliant-and your funds aren’t protected.

Write a comment