India Crypto Mining Profitability Calculator

Calculate your potential profitability after India's strict tax regime. Note: The government treats all mined cryptocurrency as taxable income with a 30% tax rate, 1% TDS, and 18% GST on transactions.

Estimated Annual Revenue

₹0

Total Annual Tax

₹0

Annual Electricity Cost

₹0

Net Profit/Loss

Key Tax Components:

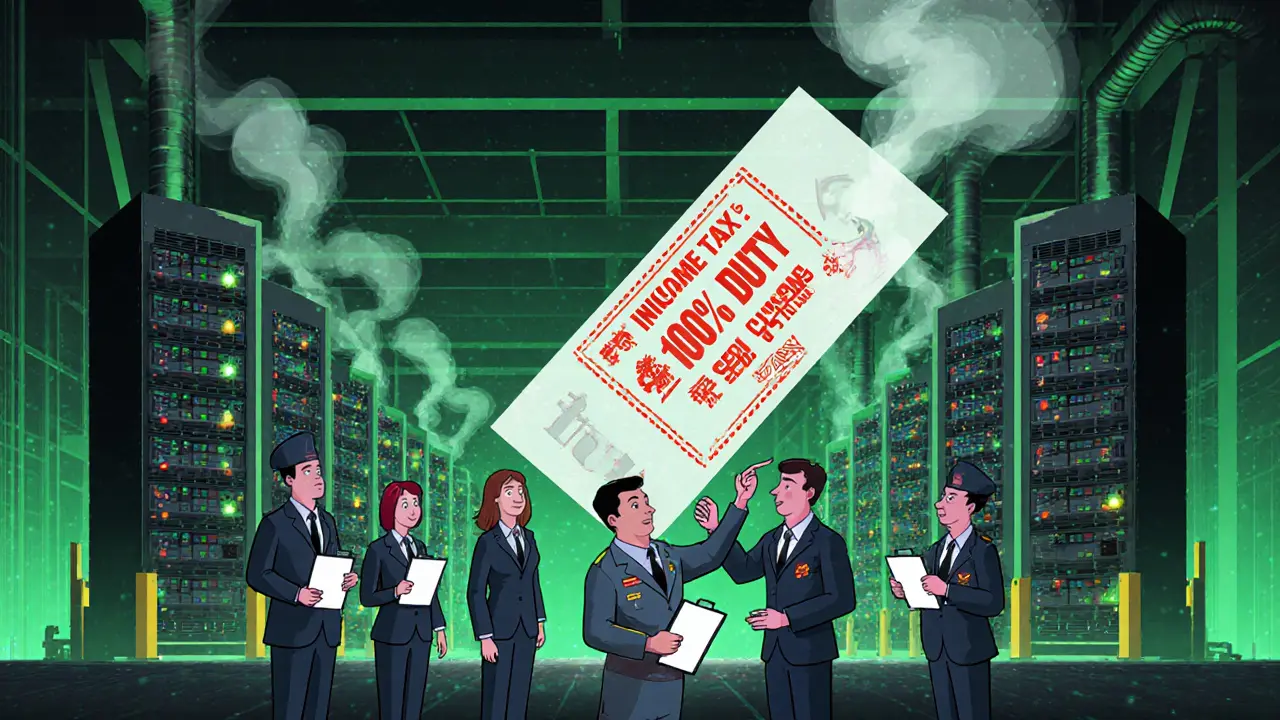

Can you legally mine cryptocurrency in India? The short answer is: yes-but it’s not simple, and it’s getting harder. There’s no outright ban on crypto mining, but the government has built a web of taxes, reporting rules, and enforcement tools that make it nearly impossible to mine profitably without risking serious legal consequences.

It’s Not Illegal, But It’s Heavily Taxed

India doesn’t have a law that says mining Bitcoin, Ethereum, or any other crypto is illegal. But since 2022, the government has treated all mined cryptocurrency as a Virtual Digital Asset (VDA) under the Income Tax Act. That means every coin you mine is treated like income-and taxed at 30%. That 30% tax rate isn’t just high. It’s one of the highest in the world. And it gets worse. You can’t deduct any of your actual mining costs. No matter how much you spend on electricity, cooling systems, ASIC miners, or pool fees, the law says you can only subtract the cost of acquiring the coin. Since you didn’t buy it-you mined it-that cost is usually zero. So you pay 30% on the full market value of every coin you mine. Add a 4% cess on top of that, and you’re already at 31.2%. Then there’s the 1% Tax Deducted at Source (TDS) on every crypto transaction. If you sell your mined Bitcoin to pay your electricity bill, or swap it for USDT on an exchange, 1% is taken right away. That’s not optional. The exchange does it for you.What Happens When You File Your Taxes?

Every year, Indian crypto miners must report their mining activity in Schedule VDA of their Income Tax Return. You need to list:- The date you mined each coin

- The name of the cryptocurrency

- The fair market value in INR on the day you mined it

- Any TDS deducted

- Where you stored or transferred the coins

Who’s Watching You?

It’s not just the tax department. Five different agencies are involved in monitoring crypto mining:- Income Tax Department - Tracks taxable income from mining

- Financial Intelligence Unit (FIU-IND) - Enforces anti-money laundering rules under the Prevention of Money Laundering Act (PMLA)

- Reserve Bank of India (RBI) - Still warns the public about crypto risks, even though it can’t ban it anymore

- Securities and Exchange Board of India (SEBI) - Since April 2025, it’s monitoring tokens that act like securities

- Customs Department - Checks imports of mining hardware, which face high duties

Big Fines, Big Pressure

The government isn’t just talking. It’s collecting fines. In 2025, Binance was fined ₹18.82 crore (about $2.17 million) for failing to report user data under PMLA. Bybit paid ₹9.27 crore ($1.07 million) for the same violation. Both platforms are now registered with FIU-IND, meaning they must share user data with Indian authorities. That means if you mine crypto in India and use Binance or Bybit to sell it, your name, address, wallet ID, and transaction history are now in the government’s hands. There’s no hiding.18% GST on Everything

On top of income tax and TDS, there’s GST. Since July 7, 2025, all crypto-related services-including trading, converting, and even paying for mining pool fees-are subject to 18% GST. So if you use a mining pool based in the U.S. and pay them in USDT, that payment gets taxed at 18% when converted to INR. This isn’t just about selling your coins. Even using crypto to pay for operational costs triggers GST. That makes every step of mining more expensive. The total effective tax burden for a miner can easily exceed 49%-and that’s before you factor in electricity, hardware depreciation, or internet bills.Why Mining Is No Longer Profitable for Most

Let’s say you mine 1 BTC in a year. At ₹50 lakh per BTC, that’s ₹50 lakh in taxable income. You pay ₹15 lakh in tax, ₹50,000 in TDS, and another ₹9 lakh in GST if you convert it to INR. That’s ₹24.5 lakh gone before you even cover your costs. Now add electricity. A typical home mining rig in India uses 1.5-2.5 kW. At ₹8 per unit, running it 24/7 costs ₹10,000-₹16,000 a month. That’s ₹1.2-₹1.9 lakh a year. Add cooling, internet, and equipment depreciation-another ₹2-3 lakh. Your total costs? Around ₹3.5 lakh. You mined ₹50 lakh worth of Bitcoin. You paid ₹24.5 lakh in taxes. You spent ₹3.5 lakh on power and gear. You’re left with ₹22 lakh. But wait-you didn’t get to keep that ₹22 lakh. You still owe taxes on it. Because you didn’t deduct your costs, the government treats the entire ₹50 lakh as profit. You’ve paid 30% on the full amount. You’re not making money-you’re paying to mine.

What About Big Mining Farms?

Commercial mining operations face even bigger hurdles. Importing mining rigs from China or the U.S. triggers high customs duties. There’s no official policy on setting up industrial-scale mining farms. No zoning rules. No power allocation guidelines. No clear permits. Power companies won’t give bulk electricity contracts to crypto miners. Many states, including Maharashtra and Telangana, have quietly blocked new crypto mining applications. Banks won’t open business accounts for mining companies. The government hasn’t said mining is illegal-but it’s made every step of doing it legally risky and financially unviable.What’s Next? The Future Is Unclear

In June 2025, the government released a discussion paper proposing a full regulatory framework for crypto. It invited feedback from exchanges, banks, and miners. But no one knows what will come next. India plans to adopt the OECD’s Crypto-Asset Reporting Framework (CARF) by April 2027. That means if you mine crypto outside India-say, in Georgia or Kazakhstan-you’ll still have to report it to the Indian tax department. Your global mining income will be tracked. There’s also talk of a complete ban. The Finance Ministry has drafted bills in the past that would make holding or mining crypto illegal. Those bills haven’t passed-but they’re still in the system. The Supreme Court has already said the government has the power to ban crypto entirely.What Should Miners Do?

If you’re already mining:- Keep every receipt-equipment, electricity, pool fees

- Record the exact date and value of every coin you mine

- Report everything in Schedule VDA

- Don’t use unregistered exchanges

- Don’t try to hide transactions

- Do the math-your costs will likely exceed your after-tax returns

- Consider whether the legal risk is worth it

- Watch for new rules in 2026

Is crypto mining legal in India in 2025?

Yes, mining cryptocurrency is not explicitly banned in India as of 2025. However, it operates under strict tax and reporting rules. All mined crypto is treated as a Virtual Digital Asset (VDA), subject to a 30% income tax, 1% TDS, and 18% GST on transactions. While not illegal, the financial and compliance burden makes it extremely difficult to mine profitably or without risk.

Do I have to pay tax on mined crypto even if I don’t sell it?

Yes. Under India’s VDA rules, the moment you mine a cryptocurrency, it becomes taxable income. You pay 30% tax on its fair market value in INR on the day you receive it-regardless of whether you sell, hold, or transfer it later. Not selling doesn’t avoid the tax.

Can I deduct mining expenses like electricity and hardware from my taxes?

No. India’s tax law allows no deductions for mining costs-electricity, cooling, equipment, or pool fees. The only allowable deduction is the cost of acquisition. Since you didn’t buy the crypto, you acquired it at zero cost. This means you pay 30% tax on the full value of every coin you mine, even if your expenses were higher than your income.

What happens if I don’t report my crypto mining income?

The Income Tax Department uses AI systems like Project Insight and NUDGE to track crypto transactions across exchanges and wallets. If you don’t report mining income, you’ll likely receive an automated notice. Penalties start at 50% of the unpaid tax and can go up to 200%. In cases of intentional concealment, you could face criminal charges and up to seven years in prison.

Can I mine crypto using offshore exchanges or pools?

Yes, but you still have to report it. India is preparing to adopt the OECD’s Crypto-Asset Reporting Framework (CARF) by April 2027. This will require Indian residents to declare all global crypto activities-including mining done on foreign platforms. FIU-IND has already targeted offshore exchanges like Huione and BitMex to identify Indian users. Not reporting offshore mining is a high-risk move.

Is there a chance crypto mining will be banned in India?

Yes. While mining isn’t banned today, the government has drafted bills in the past that would make all crypto activities-including mining-illegal. The Supreme Court has affirmed the government’s power to ban crypto. The current tax regime may be a step toward making mining unviable before a full ban is introduced. Regulatory uncertainty remains high.

Are there any tax benefits for small-scale miners?

No. India’s crypto tax rules apply equally to individuals and businesses. There are no exemptions for small-scale or hobby miners. Even if you mine just one Bitcoin per year, you’re subject to the same 30% tax, 1% TDS, and 18% GST. The system does not distinguish between casual and commercial mining.

Can banks or payment platforms freeze my account for mining crypto?

Banks don’t directly ban mining, but they can freeze accounts if they detect suspicious transactions linked to unregistered crypto exchanges or unreported income. The Reserve Bank of India has warned financial institutions about crypto-related risks. If your account shows frequent transfers to or from crypto platforms, especially offshore ones, your bank may flag it for AML review and temporarily freeze funds until you provide proof of legal compliance.

Write a comment