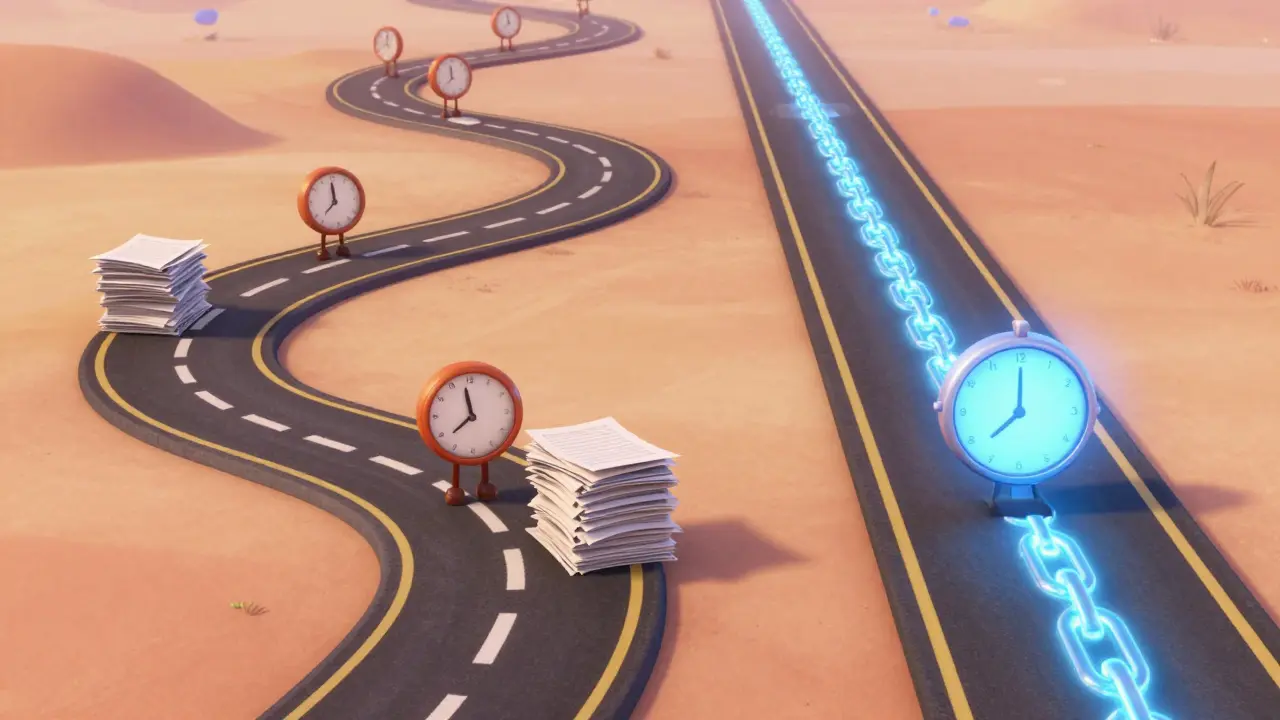

Imagine closing a real estate deal in two days instead of two months. That’s not a fantasy-it’s happening now with blockchain technology a decentralized digital ledger system that records transactions securely and transparently. Traditional property transfers typically take 30-60 days due to manual paperwork, multiple intermediaries, and slow verification steps. But blockchain is changing that.

The Traditional Real Estate Process: Why It Takes So Long

Traditional property transactions involve multiple manual steps. Title searches alone take 7-10 days. Mortgage processing adds 15-21 days. Escrow services require another 5-7 days. Each step depends on different parties-realtors, title companies, lawyers, and banks-each adding delays. This process typically takes 30-60 days to close, according to Cushman & Wakefield's 2018 research. The problem? Every manual check creates bottlenecks.

How Blockchain Slashes Transaction Time

smart contracts self-executing agreements with terms written in code that automatically verify and enforce transactions replace manual verification. For example, instead of waiting days for a title search, a blockchain system checks property records in under four hours. Consensys' 2022 report shows blockchain reduces 12-15 manual steps to just 3-4 automated ones. Each step that previously took 24-72 hours now finishes in under five minutes.

Real-World Examples of Blockchain Speed

Propy closed a property sale in Vermont in 72 hours-compared to the state’s average 35-day closing time. Sweden’s Lantmateriet land registry pilot achieved 90% faster title transfers. JLL documented a $3.5 million commercial property sale settling in 96 hours. A Reddit user in Austin, Texas reported a Propy transaction closing in four days versus the county’s typical 32-day average. These examples prove blockchain’s speed potential in real-world scenarios.

Technical Breakdown: What Makes Blockchain So Fast?

Ethereum a blockchain platform known for smart contract functionality processes transactions in 15-30 seconds per block confirmation. Bitcoin SV (BSV) a blockchain optimized for high transaction throughput handles 50,000 transactions per second. Smart contracts automatically verify identities using blockchain passcodes. This eliminates the need for repeated checks at each transaction stage. As explained in the Texas Real Estate Research Center’s 2021 analysis, this cuts verification steps from 12-15 to just 3-4.

Challenges and Limitations

Blockchain isn’t perfect yet. Some jurisdictions still require physical documents, negating 60-70% of potential time savings. A February 2023 Trustpilot review of ShelterZoom reported delays because the county recorder’s office needed physical paperwork despite blockchain verification. Integration with legacy systems also takes 6-9 months. Real estate professionals need 80-120 hours of training to use blockchain platforms effectively. These challenges mean adoption isn’t universal-but progress is being made.

The Future of Blockchain in Real Estate

The global blockchain real estate market is projected to reach $1.74 billion by 2028. Companies are working on faster solutions: Propy’s Q3 2023 update reduced average transaction time to 58 hours. The Federal Reserve’s Project Hamilton experiment showed blockchain transactions could settle in under 15 seconds with central bank digital currencies. With coordinated regulatory updates, experts estimate average closings could drop to 24-48 hours by 2027. This blockchain real estate innovation is reshaping how we buy and sell property.

How much faster can blockchain make real estate transactions?

Blockchain reduces closing times from the industry standard of 30-60 days to just 2-7 days. For instance, Propy closed a Vermont property sale in 72 hours versus the state’s typical 35-day average. Smart contracts automate title checks, mortgage processing, and fund transfers, eliminating manual delays at each step.

What’s the biggest hurdle to adopting blockchain in real estate?

Jurisdictional compatibility is the main challenge. In states requiring wet signatures for deeds, blockchain’s digital verification can’t fully replace physical documents. This negates 60-70% of potential time savings. Integration with legacy systems also slows adoption, requiring 6-9 months of technical work for real estate firms.

Do I need special training to use blockchain for property transactions?

Yes. Real estate professionals need 80-120 hours of training to master blockchain platforms. The National Association of Realtors’ 2023 certification program found most agents require this learning curve before handling transactions independently. However, user-friendly interfaces are reducing this barrier over time.

Is blockchain secure for property transactions?

Blockchain’s immutable ledger makes it highly secure. Once a transaction is recorded, it can’t be altered or deleted. This prevents fraud like title theft, which costs homeowners $1.5 billion annually in the U.S. However, security depends on proper implementation-poorly coded smart contracts could introduce vulnerabilities.

Can blockchain handle international real estate deals?

Absolutely. Cross-border transactions typically take 60-90 days traditionally due to currency exchanges and legal differences. Blockchain cuts this to 5-10 days by automating compliance checks and using digital currencies. The $8.5 trillion global real estate investment market is increasingly adopting blockchain for international sales to avoid lengthy processing times.

Write a comment